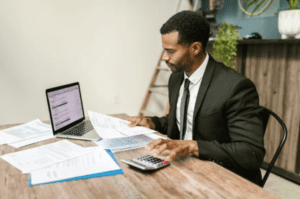

Getting a Personal Loan: How to Apply and Get Approved

The process of getting a personal loan can be complicated and daunting. You may not know where to start or how to get approved for the loan you need. But never fear! We’re here to give you some tips on making the process easier and faster. We’ll start with what type of personal loans are available. Then we’ll go over several steps that will help you apply successfully for your loan. Don’t worry; it’s simpler than it sounds! You can also see the best personal loan rates at SFGate.com.

Know the Basics of a Personal Loan

First and foremost, you should know the basics of a Personal Loan. A personal loan is an unsecured form of borrowing money from a lending institution or bank. There are no collateral requirements for this particular kind of loan, which means that there are minimal requirements for choosing your lender. You can find the most common types of lenders in your local bank or credit union, online lenders, and even peer-to-peer lending platforms.

First and foremost, you should know the basics of a Personal Loan. A personal loan is an unsecured form of borrowing money from a lending institution or bank. There are no collateral requirements for this particular kind of loan, which means that there are minimal requirements for choosing your lender. You can find the most common types of lenders in your local bank or credit union, online lenders, and even peer-to-peer lending platforms.

The interest rates on personal loans can vary depending on your credit score and the lender you work with. The average APR for personal loans ranges from 12% to 36%.

Get Pre-approved for a Loan

Get pre-approved for a loan before actually applying for one. You might have a particular reason you need to get a loan as soon as possible, but please do not just apply for the first loan offer that comes your way. It is best to pre-qualify with multiple lenders before diving in and committing yourself to an application process. This will give you some leverage and might even get you a lower interest rate.

Once you have found a lender, make sure to gather all the required information upfront so that the process goes as quickly and smoothly as possible. This will include your Social Security number, proof of income, recent pay stubs, bank statements, and credit score (if available).

Shop Around for the Best Rates

Compare the rates offered by different lenders before you apply. Don’t just go with the first offer you receive. This way, you can find the best personal loans that will suit your needs without hurting your budget. Some lenders have a good track record of lending to the less fortunate, so that they may be more open to lending you money even without your best credit score.

Compare the rates offered by different lenders before you apply. Don’t just go with the first offer you receive. This way, you can find the best personal loans that will suit your needs without hurting your budget. Some lenders have a good track record of lending to the less fortunate, so that they may be more open to lending you money even without your best credit score.

To get a personal loan, you should know the qualifications and requirements. You can apply for a personal loan online or at your bank with no credit check needed! With so many options available to you, it’s easy to find one that fits your needs. We are here to help guide you through applying for a personal loan so give us a call today!